Financial planning done right, created

by and for the digitally

native generation

The process, principles, and tools behind what we do

The old way of doing financial planning

This might be fine for your grandfather working with his golfing buddy at the traditional wealth management firm, wearing fancy suits and meeting up in the expensive downtown office with walls full of leather-bound books that smell of rich mahogany. But for the rest of us, we think there are better ways of doing things in the modern world.

The Next Gen approach to financial planning

We believe that financial planning should be:

Once we have a clear picture of where you are now and where you’re going, we’ll create a clear step-by-step action plan together. As life happens along the way, we’ll be right by your side to keep you on track.

Our shared client portal helps make sure that we each always know exactly what needs to be done to transform your vision into reality, and our annual service calendar serves as a backstop to make sure we don’t ever let important financial planning topic areas slip through the cracks and go too long without review.

Our core philosophy of what financial planning should be revolves around 7 principles:

Principle #1

People over numbers

A good financial plan covers a wide range of topic areas including cash flow, tax planning, estate planning, investment analysis, risk management, and many others. What makes a good plan great, however, is ensuring that all those decisions are aligned with the core values and life goals of the real people behind the spreadsheets. We don’t optimize for maximizing net worth, we optimize for maximizing life impact and the probability of accomplishing the things that are most important to you. We truly care for our clients and love the impact that we can help create when they’re open to deeper dives.

Principle #2

This is an ongoing process

Any document or spreadsheet built as a “financial plan”, no matter how thoughtfully constructed, will be limited. Life throws curveballs, and people change over time. It’s impossible for future projections to account for whatever the actual inflation rate ends up at 17 years from now, or how the tax code will change, or the new direction you take later in your career, or the amount of financial support you may provide to your parents in their later years. Flexibility is an important consideration in all financial planning decisions because the future is unpredictable, and a financial plan isn’t something that we can just knock out one time and be done with. The plan is not the plan, the process is the plan.

Principle #3

Action over analysis

The days of those old 300-page binders full of charts and graphs printed out from financial planning software are (thankfully!) over now. Nobody ever knew what they were supposed to do with those things anyway. Running the numbers to create long-term projections is a useful way to make more informed decisions about the likely outcomes of comparative paths, but we know from the start that those numbers can’t possibly be perfect. Even if they are perfect, they’re useless if the underlying assumptions about our actions don’t end up coming true or if we don’t take concrete steps together to make it happen. So we do our best to focus on accuracy rather than precision in our analysis, and to focus on action over analysis. We’re your partner in helping you get organized and actually finish the things you need to do, rather than just serving as a calculator or a sounding board. To support this approach, we’ve built a portal with shared access for clients to see current action items and everything coming up on our annual service calendar.

Principle #4

Financial planning is for everyone

We started this firm as an alternative option to traditional wealth management firms focused on retirees with multi-million dollar account minimums. Some of those firms do great work, but they’re not accessible to people who are still early in their journey to build wealth and their service models aren’t a fit for younger clients with completely different financial planning concerns than their grandparents. We vehemently disagree with most of the industry that people in their 20’s – 40’s don’t need financial planning services simply because they generally don’t have as much to invest or are far from retirement. In fact, we think there’s much more opportunity to set people on the right path and have a bigger impact by starting earlier.

Principle #5

Open communication is critical

We want to hear all about your dreams, goals, successes, and challenges. It’s not our place to tell you what we would do in your situation, but rather to ask great questions to help you uncover your goals and make more informed decisions about how to get there. Remember that every life decision is, at some level, also a financial decision. Personal finance is personal, and no topic is off-limits. It can sometimes feel a bit awkward at first to get “financially naked” with someone, but it really does help us to ensure that we’re aiming in the right direction with our recommendations.

Principle #6

We do what works

We believe in an evidence-based approach to investing and other financial planning topic areas. Every member of our team has the education, experience, and demonstrated expertise to provide qualified and appropriately thorough advice. We don’t pretend to have magical insights about timing the ups and downs of financial markets, or go along with the latest trends on social media, or jump at every hot new insurance or investment product that comes out. Professional development is a high priority and an ongoing effort for our team.

Principle #7

We are 100% fiduciary and fee-only

We are only paid directly by our clients, so you can have confidence that we’ll never make a recommendation for a specific financial product or course of action because we benefit from you doing so. Our transparent flat rates are based on the complexity of your situation, covering both financial planning and investment management services regardless of account size.

Here are a few of the major topic areas we’ll cover together while creating your financial plan together

Comparing the options

See a few of the reasons that we stand out

| Do It Yourself | Robo-Advisor (Betterment/Wealthfront/etc) | Traditional RIAs/Wealth Managers | Insurance-based Advisors & Commissioned Brokers | Friends & Family | Online Courses (Udemy/Coursera/etc) | Personal finance books/podcasts/blogs | ||

|---|---|---|---|---|---|---|---|---|

| Financial planning services | ||||||||

| Proactive guidance on wide-ranging financial questions | ✓ | ✓ | ✓ | |||||

| Integration between financial topic areas | ✓ | ? | ✓ | ✓ | ||||

| Thoughtful discussion of life goals, values, & how they affect finances | ✓ | ? | ? | |||||

| Detailed projections with advanced tools to make more informed decisions | ✓ | ✓ | ✓ | |||||

| Evaluate tax planning opportunities | ✓ | ✓ | ✓ | |||||

| Review employee benefits and provide open enrollment guidance | ✓ | ✓ | ✓ | |||||

| Student loan planning | ✓ | |||||||

| Develop plan to pay down credits cards, auto loans, and other debt | ✓ | ? | ? | |||||

| Cash flow modeling | ✓ | ? | ✓ | ✓ | ? | |||

| Coordinate with other professionals (tax preparer, attorney, etc) | ✓ | ✓ | ✓ | |||||

| Equity compensation (ISO, NQSO, 83b, etc) review and strategy | ✓ | ✓ | ✓ | |||||

| Step-by-step action plan with accountability partner | ✓ | ? | ||||||

| Fiduciary standard to act in your best interest at all times | ✓ | ✓ | ✓ | |||||

| Save time by outsourcing analysis | ✓ | ✓ | ✓ | |||||

| Assistance from well-qualified, experienced, credentialed professionals | ✓ | ✓ | ✓ | |||||

| Transparent & flat pricing based on complexity and needs | ✓ | |||||||

| Financial plan that includes assets not managed by firm | ✓ | ✓ | ||||||

| Investment management services | ||||||||

| Broad diversification | ✓ | ? | ✓ | ✓ | ✓ | |||

| Tax-efficient investments | ✓ | ✓ | ✓ | |||||

| Guidance selecting account types and contribution rates | ✓ | ✓ | ✓ | |||||

| Use of low-cost passive index funds | ✓ | ✓ | ✓ | |||||

| Counseling through turbulent markets to help keep you on track | ✓ | ? | ✓ | ✓ | ? | |||

| Tax loss (or tax gain) harvesting | ✓ | ✓ | ✓ | ✓ | ||||

| Periodic rebalancing to maintain your intended allocation | ✓ | ✓ | ✓ | ✓ | ||||

| Personalized portfolio aligned with your financial plan | ✓ | ✓ | ✓ | ✓ | ||||

| Research-backed methods to determine asset allocation | ✓ | ✓ | ✓ | ✓ | ||||

| Performance reporting to measure progress over time | ✓ | ✓ | ✓ | ✓ | ||||

| Save time by outsourcing portfolio management | ✓ | ✓ | ||||||

| Education | ||||||||

| A trusted, knowledgeable, experienced partner to ask personalized questions | ✓ | ✓ | ✓ | |||||

| Provided by credible professionals | ✓ | ✓ | ✓ | ? | ? | |||

| Independent sources free of affiliate links or product sales commissions | ✓ | ✓ | ✓ | ? | ? | |||

| Wide-ranging, informative, and accessible personal finance content | ✓ | ? | ✓ | ✓ |

The information presented above is believed to be factual, broadly representative, and up-to-date, but we do not guarantee its accuracy and it is not intended as a complete analysis or a recommendation. Please consult our Form ADV and additional details on the SEC’s website at adviserinfo.sec.gov to learn more about the services provided by Next Gen Financial Planning. Always review any firm’s disclosure statements and regulatory filings before doing business with them.

Modern tools to make your life easier and keep us organized

Less time logging in to multiple accounts, sorting through old emails, and trying to find the important parts of that old 300-page binder. More time on the conversations and the actions that truly matter.

RightCapital

Live tracking of all of your financial accounts in one place! We use RightCapital as our primary financial planning software to help us organize your financial life together, as well as run detailed projections to make more informed decisions about expected outcomes.

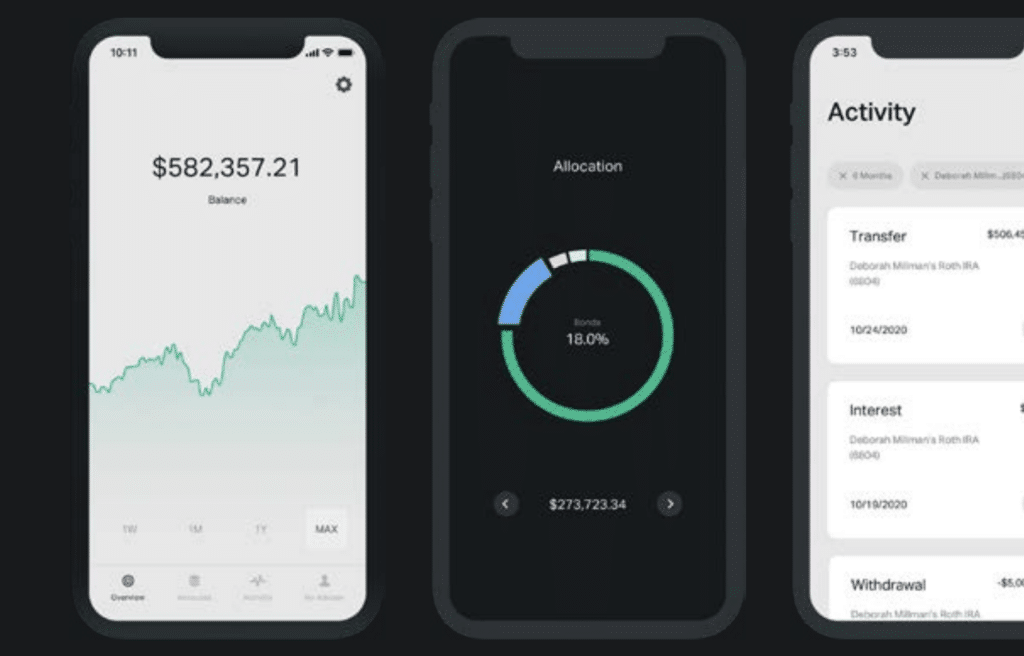

Altruist is an all-in-one modern investment platform that helps us provide you with access to commission-free trading, digital account opening in seconds, simple transfers, lower costs, performance reporting, smart rebalancing features, and a beautiful user experience.

Our shared client portal custom-built on monday.com

All of the financial planning and analysis in the world won’t matter if we don’t actually get things done together. We built a shared client portal to help you stay on top of clearly-stated action items, give you better visibility of what we’re working on for you in the background between meetings, enable easy in-context communication, securely share files, and keep track of upcoming topic areas to be reviewed throughout the year. Check out this preview of a demo version.