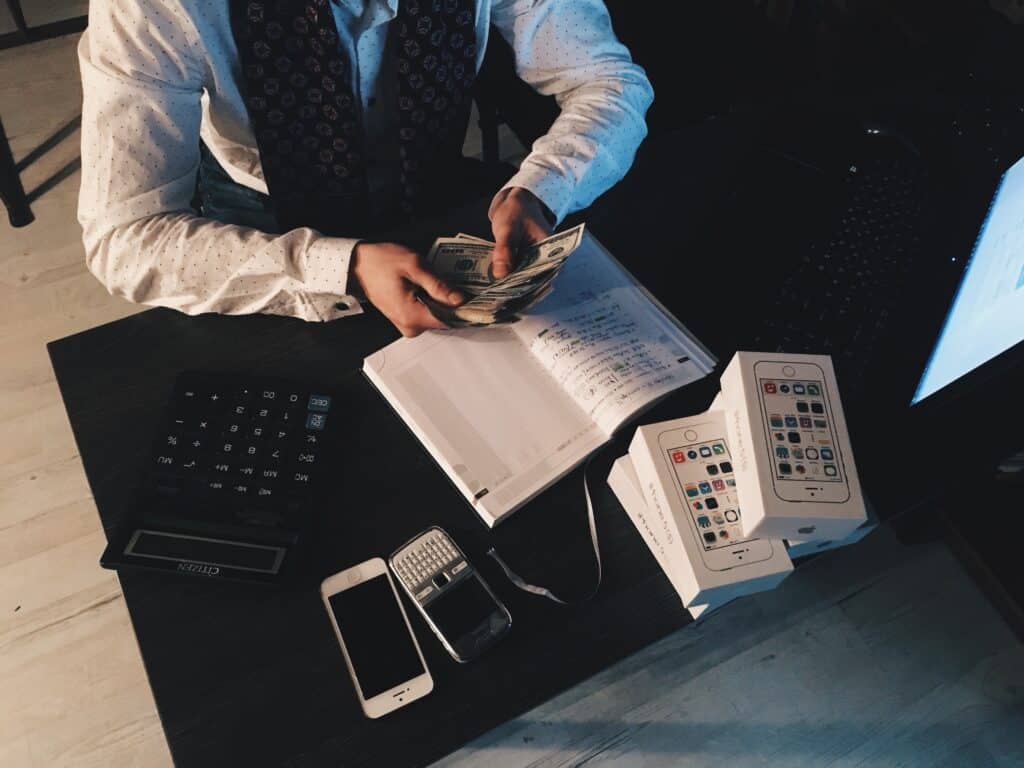

When it comes to personal finance, there is a lot more than meets the eye. Psychology plays a big role in how we manage our money. From spending habits to investment choices, our emotions, and subconscious mind can have a major impact on our financial decisions.

Whether we realize it or not, our financial behavior is often driven by psychological factors. Understanding these underlying motives can help us make better choices with our money. Take a closer look at the psychology of personal finance, Next Gen will provide you will facts as to how you are impacted.

The Impact Psychology Has on Personal Finance

One of the biggest psychological factors affecting our financial decisions is emotion. Our emotions can drive us to make good or bad choices regarding spending money. Fear of loss, for example, can make us hesitant to take risks, while greed may lead us to make risky investments hoping for a big payout. The way we think about money itself can impact us all, and sometimes it is best to have a financial planner help you set up your game plan!

Money Decisions Are Driven by Emotions, Not Purely Logic

Even experienced investors and traders can be swayed by irrational thoughts when making decisions. Understanding the psychological factors at play in personal finance is important for avoiding these mistakes and making sound financial choices. When you are ready give us a ring at (619) 273-3561.

The Financial Psychology Institute

The Financial Psychology Institute is a research and teaching organization specializing in the psychological aspects of financial decision-making.

They aim to serve individuals, families, businesses, and society as a whole by improving financial literacy and psychological well-being. They have added several adjunct faculty members who are experts in the field of financial psychology. The Financial Psychology Institute offers financial planning and financial services to improve financial behaviors and financial well-being.

Our certified financial planners at Next Gen can create customized strategies and plans of action specifically tailored to individuals. We know one size does not fit all!

Our Upbringing Money

The importance of understanding our relationship with money and the behavioral psychology behind it cannot be overstated. Despite what many of us were taught about relying solely on financial planners and mental wealth advisors, it is more critical than ever to take an active role in managing our finances from an early age! From a behavioral finance standpoint, our upbringing strongly influences how we think, conduct ourselves in the marketplace, and ultimately use our money today.

The Role of Emotions in Financial Success

Managing principal personal finances is an essential part of success when it comes to fiscal security. An individual’s ability to be aware of their emotions and how they play a role in their financial habits can be a key factor when managing money. When making vital financial decisions, look no further than our advisors at Next Gen. With years of experience under our belt, we provide trustworthy and impartial direction that you can rely on without hesitation!

Financial stress, while a normal feeling, can sometimes cause bad decisions and hinder progress in managing debt or forming savings plans. It’s important to recognize feelings associated with money management and how they can impact our day-to-day activities involving money.

Here are Some Common Psychological Influences

Fear:

This can lead to short-term decisions intended to reduce immediate risk, but which can lead to bigger losses in the long run.

Greed:

The desire for quick and easy profits can lead to overconfidence, excessive risk-taking, and poor investment choices.

Bias:

People are prone to overestimate the probability of events that are easy to recall or have recently occurred. Thus, they may fail to consider unlikely outcomes in evaluating a financial decision.

Impulse Control:

The ability to resist temptation is essential for making sound financial decisions. Financial pressure can be unbearable and irrational purchases made in haste can lead to costly mistakes.

Just Knowing Better is Not Enough to do Better in Personal Finance

The psychology of money mistakes shows we as people have cognitive biases and unconscious habits how to overcome psychological barriers. Plus, handling money better and creating a financial plan that reaches your goals & keeps you on track to making smart financial decisions.

Behavior Has a Much Greater Impact Than Knowledge

Unconscious prejudice and biases affect financial decisions. Social cues can shape our thoughts on money and investments recognizing behaviors that lead to mistakes in personal finance. People procrastinate when it comes to managing their finances and managing stress around money.

Personal Finance at its Best Requires Much Stronger Soft Skills (emotional IQ) Than Hard Skills (Knowledge About Investments):

How to harness the power of psychology when it comes to personal finance is recognized. Acknowledge your own psychological bias to be mindful of self-control when making decisions. Avoid letting loss aversion drive you away from investing in potentially profitable opportunities. Develop mental models for dealing with financial challenges, and if you do not know where to begin Next Gen is here for you!

Mental Accounting: Personal Finance is Personal

The concept of mental accounting explains why people don’t necessarily make the most rational decisions with their money. Mental Accounting is a way of grouping different parts of our finances to prioritize spending and investments. It is an emotional way to think about our financial goals and how to reach them. Mental accounting helps us understand.

Financial Psychology

Thinking beyond traditional finance financial psychology is the study of how our psychological and emotional states affect financial decision-making.

This includes recognizing cognitive biases, understanding behavioral aspects of finance, exploring the impact of emotions on financial decisions, and learning ways to overcome these behaviors and make more informed choices. In summary, financial psychology is an approach to financial decision-making which considers the emotional and behavioral elements of money management.

Financial Health

Mental health financial psychology is a growing field of study that looks at the emotional and cognitive aspects of decision-making when it comes to money. It explores our attitudes about money, how we view success and failure, and why certain financial decisions are made. Financial psychologists have helped people understand their relationship with money and how it affects their overall well-being.